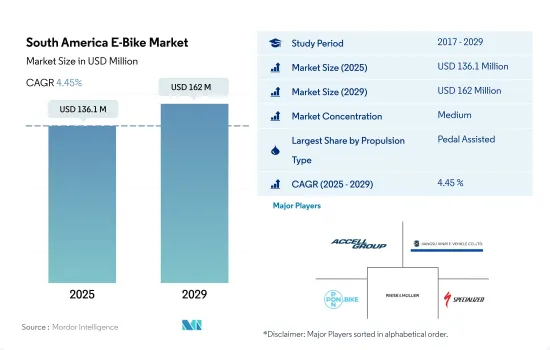

South America Electric Bicycle Market size is expected to reach USD 136.1 million by 2025 and is projected to reach USD 162.0 million by 2029, growing at a CAGR of 4.45% during the forecast period (2025-2029).

Propulsion Systems Segment Overview

The South America e-bike market is characterized by a variety of propulsion types that are experiencing significant growth and transformation. Among the various propulsion types, pedal-assisted and on-demand throttle e-bikes are the most popular. Pedal-assisted e-bikes are gaining popularity due to their efficiency and offering a more traditional riding experience, which fits well with the health and environmentally conscious consumer segment. On-demand throttle e-bikes are suitable for consumers seeking convenience and ease of use, especially in urban environments that prioritize fast and easy commuting.

However, Argentina was already facing a third year of recession in 2020, due to the economic crisis in some of its major market areas, before the global onslaught of the new Crown Pneumonia epidemic. Now, the economic impact of the epidemic is causing a record economic contraction in the crisis-affected country. However, in the near future, the market is expected to grow further as the government takes the necessary steps to get the economy back on a growth track.

As the government has strengthened its e-bike program, many bike sharing platforms have entered China to capitalize on the business opportunities it has created. The government and private investors have launched several bike-sharing programs in the country with an aim to popularize e-bikes and reduce pollution. For instance, in November 2019, PBSC Urban Solutions, a Canadian bike sharing company, announced its successful expansion in Buenos Aires, the capital of Argentina, by introducing 4,000 ICONIC bikes to the capital, doubling the number of shared bikes in the city.

Markets in South American countries

Despite the fact that the EV market in Latin America is still in its infancy, at least 45% of the countries in the region have already adopted measures in favor of EV development. A number of local and global companies have also decided to partially replace their existing fleets locally to meet GHG reduction targets and reduce costs. The Latin American region, in particular, could benefit from an accelerated transition to EVs, as it has one of the lowest GHG-emitting power generation matrices in the world, thanks to its high hydroelectricity generation and the gradual development of other renewable energy sources in the market. Public also supports the e-bike market in South American economies.

The South American e-bike market is highly fragmented and is not dominated by a few large companies that have a monopoly on the production and distribution of their products. Instead, the market is highly competitive and no single company dominates. Brands with high sales include Giant Bicycles, Merida, Trek Bikes and Riese & Muller.

With the rise in gasoline prices, there is a growing trend for the government and the general public to opt for electric bikes. Pedal-assisted electric bikes are great for short trips, so the day may soon come when the Speed Pedelec will be the most practical choice for an electric bike. In the coming years, people are expected to favor high-speed e-bikes even more as power and speed increase. In South America, throttle-assisted e-bikes are prohibited by law, but to a much lesser extent than pedal-assisted e-bikes.

South America E-Bike Market Trends

Argentina and Brazil are showing moderate growth, indicating that they are emerging markets with potential for significant future expansion.

The South America e-bike market is currently in its early stages, with only a few countries having significant sales of electric motorized vehicles and accounting for a relatively small percentage of global electric motorized vehicle sales. The main reason for this is that e-bikes are expensive and considered as luxury two-wheelers.

The shared e-bike market in the region is showing high growth. Most of the shared bike operators in Argentina and Brazil have incorporated e-bikes into their shared bike services or expanded their holdings.

The market is fragmented, with many start-ups and companies such as Giant Bicycles, EDG and Trek Bicycle Corporation entering the market. In contrast, large e-bike rental companies are expanding their market reach and increasing their e-bike holdings.

In South America, there has been an overall increase in the number of people commuting between 5 and 15 kilometers per day, reflecting a gradual change in commuting habits.

The region is home to several promising cycling countries, including Brazil and Argentina. South America is home to several promising cycling countries, including Brazil and Argentina. More and more South Americans are choosing to cycle for short distances (up to 15 kilometers). Brazil has the highest percentage of people in South America who commute between 5 and 15 kilometers per day.

Since the outbreak of C.N.C.P., people have realized that cycling is the most efficient way to commute. In addition, the number of commuters traveling between 5 and 15 kilometers per day has increased in all regions in 2021 compared to 2020, as people chose to bicycle for exercise or weekend recreation during the outbreak. In addition, the introduction of e-bikes with advanced features and a range of up to 40-45 kilometers is encouraging consumers to choose bicycles for their daily commute.

The lifting of restrictions on the new Crown Pneumonia outbreak across South America and the reopening of offices and businesses have also contributed to the increase in cycling. Many people have begun cycling to work on a regular basis. Bicycle commuting is becoming increasingly popular in countries such as Brazil because of its multiple benefits, including carbon-free transportation, fuel economy and reduced travel time. These factors are expected to accelerate commuting distances between 5 and 15 kilometers in South America over the forecast period.